5 Easy Facts About Will I Lose My Tax Refund When Filing Bankruptcy Described

The fact is, declaring bankruptcy can assist you to ultimately move ahead using your daily life. In the Woodbridge regulation Workplace of Fisher-Sandler, we support our consumers have an understanding of their rights beneath U.

Federal bankruptcy exemptions have a reasonably generous wildcard, so folks utilizing the federal exemptions can commonly guard their tax refund in total. Some states present exemptions that shield tax refunds which might be the result of a selected tax credit rating, such as Earned Money Tax Credit score or the kid and Dependent Care Tax Credit. Some states, like Arizona, do not have any security for tax refunds or a wildcard exemption.

You will get far more pay out Every single time period, and also your tax return will be Substantially smaller. Usually, these modified returns can be so small that they are deemed worthless as repayment to creditors, forcing your trustee to abandon them and letting you to maintain the total quantity.

Have creditors garnished your wages? Bankruptcy can protect against or close wage garnishment. Will you be facing foreclosure? Bankruptcy can avert or delay foreclosure and repossession.

in Pub. 538 for information on ways to annualize the debtor's cash flow and also to determine the tax for that brief tax 12 months.

In nowadays’s globe most, if not all people today truly feel uneasy Talking regarding their finances – significantly when it issues the subject of non-public bankruptcy. No person would like to acknowledge that she or he has basically been through the method because of The truth that the only real information and facts the vast majority of individuals i loved this have is whatever they listen to from family and friends Together with the media, which is so commonly negative and also sensationalized.

You make every month payments to your bankruptcy trustee, leaving barely click to investigate enough in your needed expenditures. Any surplus revenue goes on your creditors.

Filing the petition underneath chapter thirteen “routinely stays” (stops) most collection steps from the debtor or the debtor’s residence. Chapter 13 also has a Exclusive “computerized remain” provision that guards co-debtors.

Consenting to those technologies will make click site it possible for us to course of action knowledge for example browsing conduct or unique IDs on This page. Not consenting or withdrawing consent, may adversely affect particular attributes and functions.

Phase 6 – Go to Creditors Conference – The trustee also organizes the creditors’ Assembly. You will get notification from the trustee of the time and put from the Assembly, also referred to as a 341 Assembly.

When you browse around these guys full the class, you’ll receive a certificate of debtor training. In Chapter seven, you are required to accomplish The category within just sixty times from the day established for the Assembly of creditors. In Chapter 13, you need to comprehensive the class ahead of filing a motion requesting a discharge of debts.

This is typically your worst-circumstance circumstance. In any bankruptcy, the debtor can preserve a court docket-established amount of cash or belongings, called exemptions. In the event your refund is sizeable and you get it Soon before filing or it relies on dollars that was gained prior to your filing, you may be able to contain it in this exempt volume.

But fairfax bankruptcy attorney it is best To accomplish this in advance of filing for Chapter 13. You would not want it to afterwards look being an make an effort to disguise bankruptcy earnings owed to your creditors.

Unless the bankruptcy court docket authorizes or else, a creditor may not search for to gather a “buyer debt” from any specific who's liable along with the debtor. Consumer debts are All those incurred by a person primarily for a personal, family members, or residence function.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Lacey Chabert Then & Now!

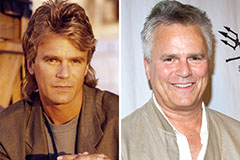

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!